Telefónica launches new green hybrid amounting to 1.1 billion euros

Published By Telefónica [English], Wed, Mar 6, 2024 1:23 PM

Telefónica has successfully issued today a €1.1bn green hybrid with a first call date in January 2032 . Also today, the company has launched a purchase offer on an outstanding hybrid which first call date is next December.

The transaction was favourably received by institutional investors. The book, which reached a demand of €4,000m before closing at around €3,500m, was closed with more than 250 orders, so that investor interest was three times the amount finally issued. The investor base, broadly diversified, stands out for the participation of international investors, representing more than 95%.

The company has managed to improve the conditions significantly. From the initial indications of a coupon of 6.25%, a reduction of 50 basis points was achieved to set the final cost at 5.75%.

The closing and final settlement of the operation will take place on March 15th.

Regarding the purchase offer to the outstanding hybrid, the process starts today and it is scheduled to end on 13 March at 17:00h. The results will be published on March 14th.

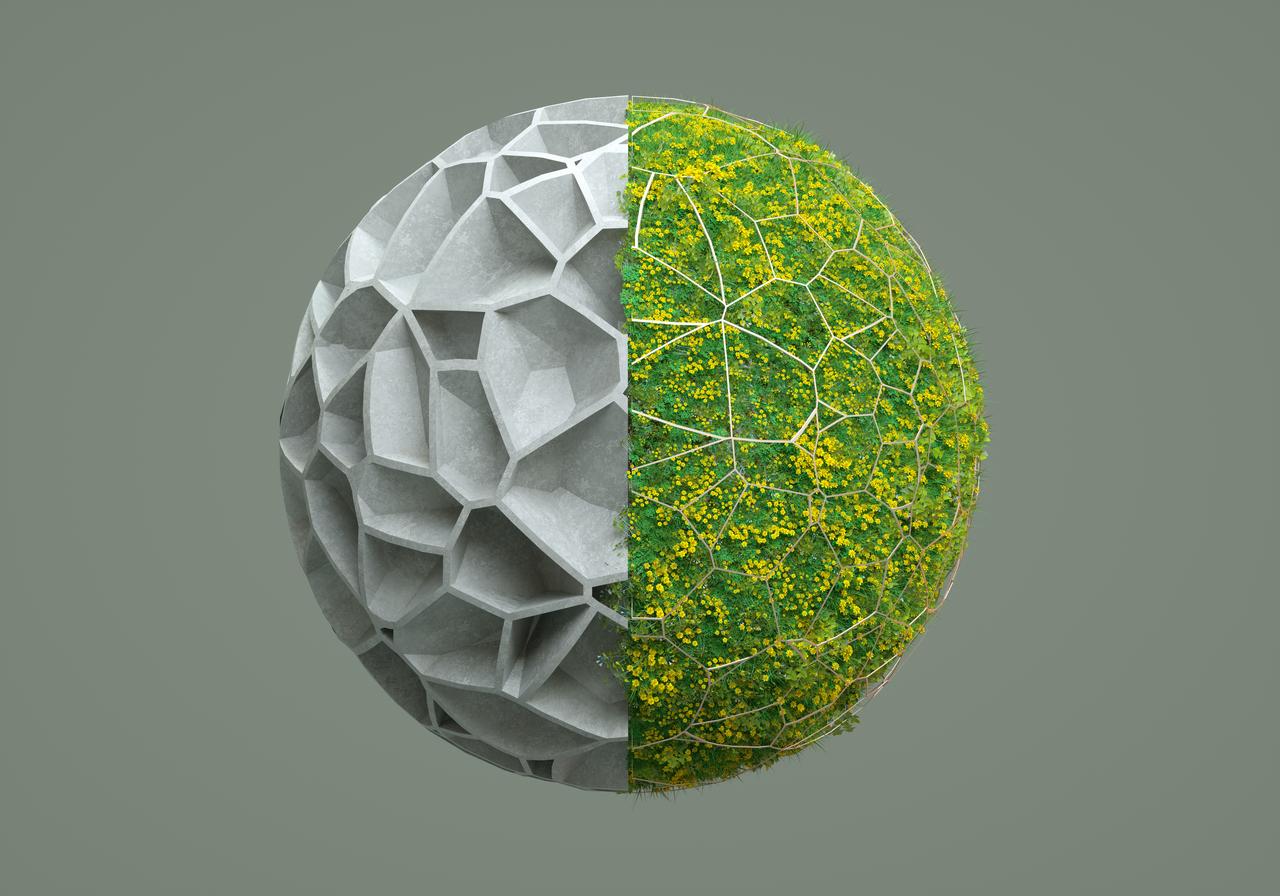

Both operations, the green hybrid issuance and the purchase offer, are aimed at continuing to proactively manage the company’s hybrid capital base, reinforcing its position as one of the leading issuers of ESG capital market financing in the international telco sector.

Today’s operation also ties in with the company’s commitment that around 40% of total financing by 2026 will be linked to ESG criteria, with the goal of aligning environmental sustainability with financial sustainability.

The new hybrid aligns with the eligible categories defined in Telefónica’s Sustainable Financing Framework, last updated in July and externally endorsed with a favourable Second Party Opinion from Sustainalytics, and the funds obtained will be allocated mainly to projects for the transformation and modernisation of telecommunications networks, both fixed and mobile, with the aim of improving their energy efficiency. Funds may also be allocated to projects related to the implementation of Telefónica’s Renewable Energy Plan, or the development of digital products and services aimed at saving energy and natural resources, as set out in the Framework. These projects are the main levers for improving efficiency and reducing the carbon footprint.

Once the projects have been identified and awarded, Telefónica will report on an annual basis on their environmental impact through indicators such as energy consumption per petabyte of data traffic, energy savings or CO2 emissions avoided.

As part of Telefónica’s financing strategy, the Group published its first Sustainable Financing Framework in 2018, subsequently updated in January 2021 and most recently in July 2023, with the aim of continuously meeting market best practices and investor expectations. All updates to the framework have received a positive Second Party Opinion from Sustainalytics.

Press release distributed by Wire Association on behalf of Telefónica, on Mar 6, 2024. For more information subscribe and follow Telefónica